To what extent are current interest rates affecting the Amsterdam housing market?

The Amsterdam housing market currently faces several challenges. In recent years, the price of a house in Amsterdam has soared. Homeowners in Amsterdam felt as if they had gold in their hands. Consequently, they had no reason to sell the home. Consequently, the homes for sale were not financially feasible for everyone. On this development the government acted and took measures. Self-occupancy obligation, decrease in the owner-occupied property tax credit and less mortgage interest deduction. All this, together with the threatening situation in Eastern Europe and now also the rising interest rates, caused a stagnation (and even a decline) in house prices.

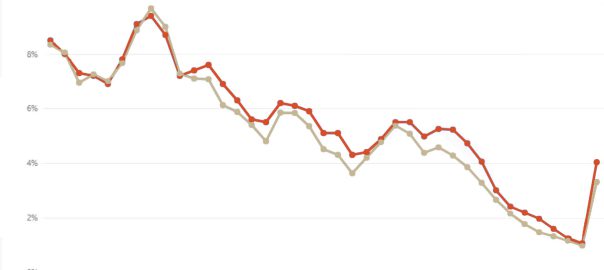

How rising interest rates are affecting the housing market

Now that the ECB has raised interest rates, it is important for both consumers and investors to understand the potential impact on the market. Higher interest rates could lead to higher interest costs for consumers, shrinking the disposable income of an average household. For businesses, higher interest rates can increase the cost of borrowing and inhibit investment in expansion or new projects.

On the other hand, higher interest rates can indicate a strong economy with low unemployment and stable inflation, leading to general market confidence and growth. However, this is not currently the case. The ECB's current policy is diametrically opposed to the policies pursued in recent years by the ECB

It is important for individuals to keep a close eye on changes in interest rates. Especially for first-time home buyers. As always, the advice of a financial advisor can help with any shifts in the market. Understanding how rising interest rates affect the market helps when making important financial decisions such as buying a home. More information about the market can be found on you the Amsterdam housing market page.

The potential impact of rising interest rates on homeowners and renters in Amsterdam

In Amsterdam, as in many parts of the world, interest rates play an important role in determining the purchase of a home. If interest rates rise, it directly affects mortgage payments and rents for tenants. This increase can have a knock-on effect on the local economy. As indicated earlier, the average disposable income per household decreases as interest rates rise. An average family has less to spend after deducting fixed expenses and therefore postpones costly purchases.

In addition, high interest rates cause the maximum amount that can be borrowed to decrease. Based on joint income, the maximum amount a household can repay is determined. This consists of part interest and part repayment. If the interest rate rises, the interest portion becomes larger, meaning that less can be repaid. However, the total sum of repayments is the maximum amount that can be borrowed.

How we as real estate agents experience the current market

As real estate agents, we see and feel uncertainty about how the market will develop. Whereas in December of 2021 there was still the lowest number of houses ever for sale, a year later there are more than 4,000 for sale again. It was also thought that there was no brake on Amsterdam house prices. Still, we see and feel a slight uncertainty emerging in the market. Demand is showing a visible decline for the first time in a long time, and supply continues to rise. These developments may cause house prices to fall.

Do you currently have questions or are unsure about a decision? Please contact us without obligation and we will be happy to discuss them with you.